LIC New Bima Bachat Plan no. 816 is a non-linked participating plan. It is a non-linked means, it is not linked to market ups and downs whereas participating means it is going to provide profit as per the experience of the corporation. It is a single premium plan which provides scheduled payment along with the return of a single premium paid plus additional benefits at the end of the term of the policy. For Old Bima Bachat Table No. 175 Click Here

Features and details of LIC new Bima Bachat plan

- LIC New Bima Bachat is a single premium plan that means the policyholder has to pay the premium only once.

- It is a money-back plan which also provides a bonus at the end of the term of the policy.

- Policy terms can be chosen as 9 years, 12 years, or 15 years.

- It provides a survival benefit at the end of every 3 years of the policy term.

- If the policyholder survives throughout the policy term the whole premium that is assured along with bonus is paid to the policyholder as maturity benefit and the policy gets terminated

- If the policyholder dies within the policy term the sum assured at the time of policy purchasing plus bonus will be given to the nominee of the policyholder as a death benefit.

Benefits provided under LIC New Bima Bachat plan

Maturity benefit

If the policyholder survives throughout the policy term then the corporation provides the whole sum of premium that is paid plus loyalty addition to the policyholder at maturity benefit.

Death benefit

If the policyholder meets to death within the policy term, then the death benefit is provided to the nominee of the policyholder.

Detail of death benefit provided

If the policyholder dies within the 5 years of the policy term then only the sum assured would be paid.

If the policyholder dies after the 5 years of the policy term then the sum assured + loyalty addition is paid as a death benefit.

Loyalty benefit

LIC New Bima Bachat policy provides loyalty addition that is declared after the completion of 5 years of the policy.

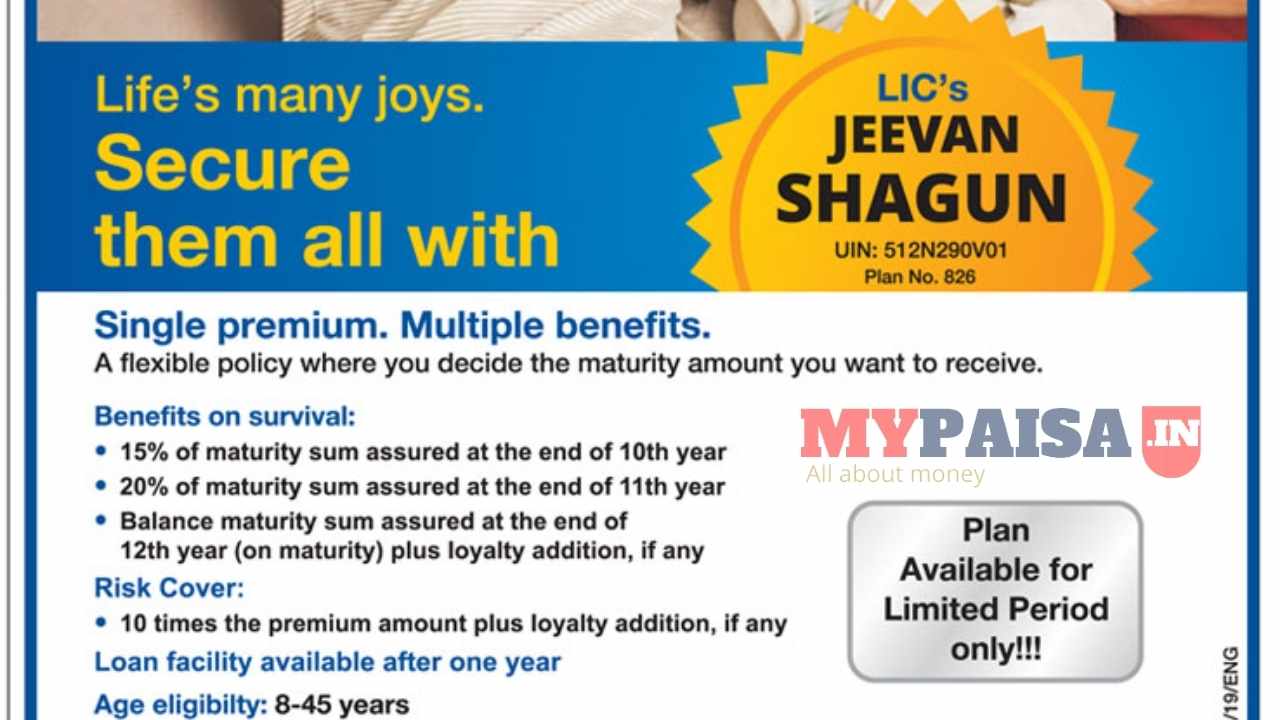

survival benefit

LIC’s New Bima Bachat plan provides a survival benefit that is 15% of the sum assured at the end of every 3 years of the policy term to the policyholder as a survival benefit. It is one of the main parts of this policy plan.

| Year: Term | 3rd Yr | 6th Yr | 9th Yr | 12th Yr | 15th Yr |

| 9 | 15% | 15% | Maturity | NA | NA |

| 12 | 15% | 15% | 15% | Maturity | NA |

| 15 | 15% | 15% | 15% | 15% | Maturity |

Eligibility Conditions and Restrictions

Tax benefit

As per the Income Tax Act, the premium paid under this plan is tax-free as per section 80 C and the claim which is received is also tax-free under section 10 D.

Eligibility criteria and premium details of LIC New Bima Bachat plan

- The minimum age for entry of this plan is 15 years and the maximum age for entry is 66 years.

- The maximum age at the time of maturity of the policyholder can be 75 years.

- The policy term can be chosen as 9 years, 12 years, or 15 years.

- The premium paying term is only single because it is a single premium pain plan.

- The minimum sum assured for the policy term of 9 years is 35000 and for 12 years is 50000 and for 15 years is 70000 and there is no upper limit for the sum assured.

Documents required for LIC new Bima Bachat plan

- Fully filled application form with photographs

- Age proof of policy buyer.

- Address proof.

- PAN card and Aadhar card for KYC document

- Accurate medical history

- Medical examination report if required.

Terms related to LIC new Bima Bachat plan

Surrender value

The corporation provides a surrender value that is within the first year of LIC New Bima Bachat Plan is 70% of the premium paid and from the second year onwards is 90% of the premium paid excluding taxes.

Exclusion

If the policyholder commits suicide within 12 months of the policy period then 90% of the premium paid is returned to the nominee of the policyholder.

Cooling off period

After purchasing the policy if the policy buyer is not satisfied with the policy then within 15 days the policy can be return after receiving the policy document.

Discounts

There is a discount allotted on the half-yearly and early mode of premium payment. 1% for half yearly premium payment and 2% for early premium payment.

Loan.

The policyholder can take a loan up to the premium amount if the policy attains a surrender value after the completion of certain years of policy paying term. As per the terms and conditions of the corporation.