Banking means cash, credit, and other financial transactions. We at MyPaisa Help you save money.

Benefits of LIC vs Post Office Recurring Scheme – Which Investment Option Is Right For You?

This article provides an in-depth comparison of the LIC vs Post Office Recurring Scheme, so you can decide which investment option is right for you. We look at the advantages of each scheme, their ...

Doorstep Banking for Life Certificates: A New Initiative for Pensioners

The recent launch of the Nationwide Digital Life Certificate (DLC) Campaign 3.0 by the Department of Pension & Pensioners' Welfare marks a significant step in simplifying the life ...

Sending Money Abroad? Learn Top 5 Challenges & How to Navigate Them

Have you ever had to send money abroad? If so, you are aware that cross-border remittances can be difficult. There are several aspects to consider when transferring money to a foreign country, ...

Earn Rewards for Paying Your Credit Card Bills & Loan EMIs with CheQ

Do you have multiple credit cards and find it difficult to keep track of due dates and avoid late payment fees? Don't let the hassle of managing multiple cards overwhelm you - take control of your ...

Ways to Apply for Holiday and Shopping Loans in India

Are you looking to enjoy the holidays or shopping season without breaking the bank? Applying for a holiday and shopping loan in India is an excellent way to save money while still creating memories. ...

8 Tips to Keep Your Bank Account Safe

The banking industry has advanced alongside technology. Nowadays, opening a digital savings account online is simple, and many people prefer online banking instead of going over to the bank and ...

Reasons Why Your Small Personal Loan May Get Rejected

A small loan may seem to be like a piece of cake, but in reality, it isn't so. If you are looking to apply for a loan of any kind, personal or business, you need to be ready for the fight. There are ...

Know the 7 Key Factors Lenders Consider to Approve Your Loan

Are you considering taking out a loan? It’s no secret that drafting an approvable loan application can be intimidating. Applying for a loan is a big decision and one that shouldn’t be taken lightly. ...

Determining if B2B BNPL is for you: a guide

Buy Now, Pay Later as a payment solution has been heating up in the B2B space. The pandemic has caused many businesses to move online, and with that, they have made great strides to improve the ...

CRED Review: Get rewards for paying your credit card bills

When I first heard about CRED, I thought its another payment platform. It's not just a credit card Payment platform it's more than that. CRED is a platform that encourages people to pay their credit ...

Chit Fund: How It works?

What is a chit fund?A chit fund is a type of savings where you deposit some amount every month to someone who manages the chit fund. Chit funds are often organized by financial institutions, or ...

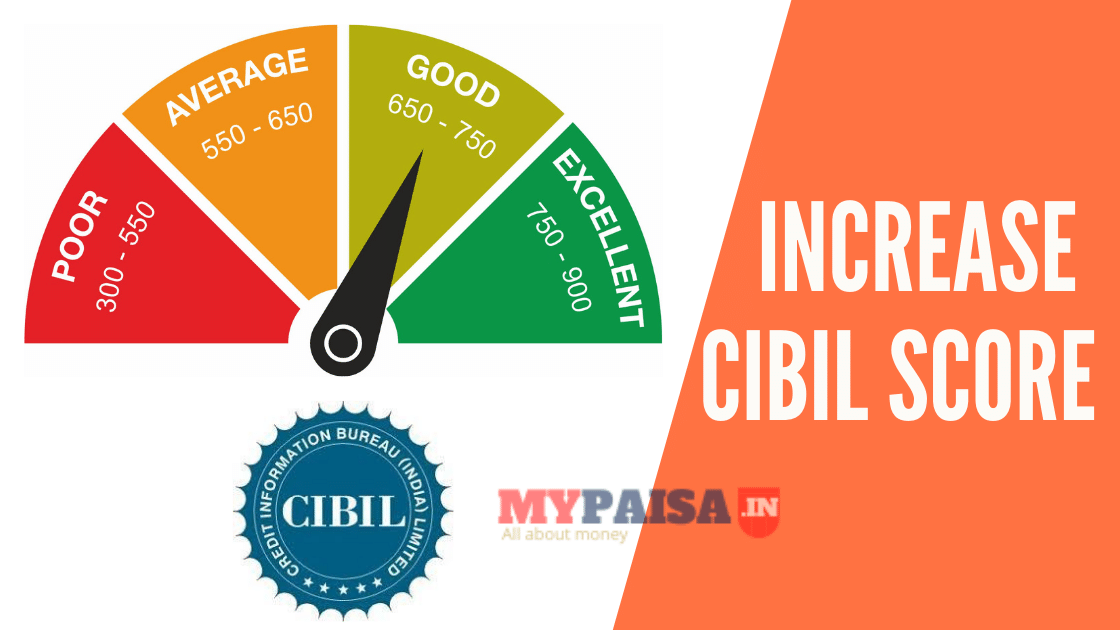

13 Tips To Increase Your CIBIL Score

We’ve all heard of the term “good CIBIL score” and, if you are reading this article, it is likely that it has been important to you. What exactly does a good credit score entail? And how do I go ...