LIC Jeevan Shagun (Table No. 826) was a single-premium money-back plan introduced in 2014 as a limited-period offer. This policy was designed to provide a combination of risk coverage and savings with money-back benefits and a maturity bonus.

Note: This plan is no longer available for purchase as it has been discontinued.

Key Features of Jeevan Shagun Plan

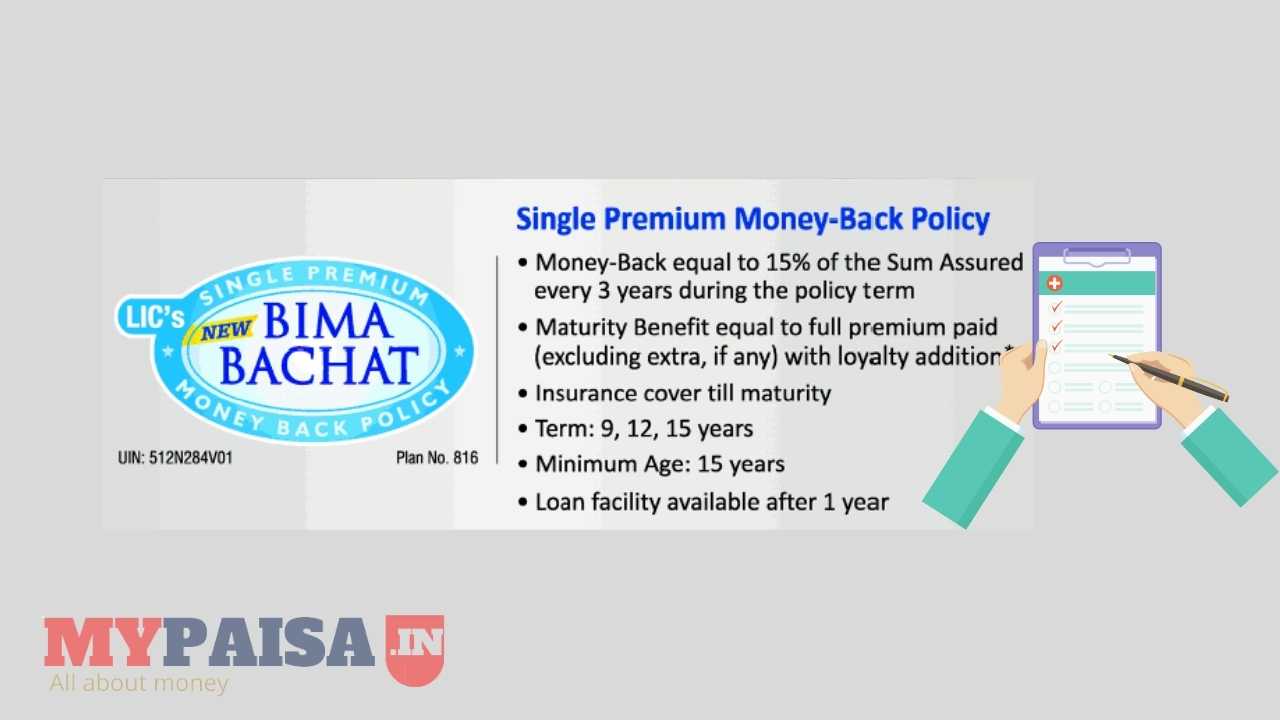

- Single Premium: Pay the premium only once at the start of the policy.

- Money-Back Benefits: Regular payouts during the policy term.

- High Sum Assured: Guaranteed risk cover of 10 times the single premium.

- Loan Facility: Loans are available after the first policy year.

- Policy Term: Fixed term of 12 years.

- Flexibility to Surrender: Option to surrender the policy at any time after the first year.

Benefits of Jeevan Shagun Plan

1. Death Benefit

- If death occurs within the first 5 years: The nominee will receive the basic sum assured (10 times the single premium).

- If death occurs after 5 years: The nominee will receive the basic sum assured plus any loyalty addition.

2. Survival Benefit

Policyholders receive money-back payouts during the last three years of the policy:

End of 12th year (Maturity): 65% of the MSA + Loyalty Addition (if applicable).

End of 10th year: 15% of the Maturity Sum Assured (MSA).

End of 11th year: 20% of the MSA.

Eligibility Criteria

- Minimum Age at Entry: 8 years (completed).

- Maximum Age at Entry: 45 years (nearest birthday).

- Policy Term: 12 years.

- Minimum Maturity Sum Assured: Rs.60,000.

- Maximum Maturity Sum Assured: No limit.

- Premium Payment: One-time (single premium).

High Sum Assured Rebate

Policyholders received discounts based on the sum assured:

- Below Rs.1,50,000: No rebate.

- Rs.1,50,000 to Rs.3,95,000: Rs.15 per Rs.1,000 of MSA.

- Rs.4,00,000 and above: Rs.20 per Rs.1,000 of MSA.

Loan Facility

Loans were available from the second policy year:

- 2nd to 3rd year: Up to 50% of surrender value.

- 4th to 6th year: Up to 60% of surrender value.

- 7th to 9th year: Up to 70% of surrender value.

- 10th to 12th year: Up to 90% of surrender value.

Surrender Value

Policyholders could surrender their policy and receive:

- 1st year: 70% of the single premium (excluding taxes and extra premiums).

- From the 2nd year onward: 90% of the single premium (excluding taxes and extra premiums), minus any survival benefits already paid.

Additional Benefit: Loyalty additions, if applicable, were included for policies surrendered after 5 years.

Example Premiums and Returns

Below is an example for a policy with a Maturity Sum Assured of ?1,00,000:

| Age (Years) | Single Premium (Rs.) |

|---|---|

| 8 | 50,880 |

| 20 | 52,390 |

| 30 | 53,736 |

| 40 | 61,380 |

| 45 | 74,106 |

Benefit Illustration for Age 30

- Single Premium Paid: Rs.53,736 (including taxes).

- Risk Cover: Rs.5,21,250 (10 times the premium).

- Survival Benefits:

- 10th Year: ?15,000.

- 11th Year: ?20,000.

- 12th Year (Maturity): Rs.70,000 (includes loyalty addition of approx. Rs.5,000).

Conclusion

LIC Jeevan Shagun Plan No. 826 was a popular single-premium plan for a limited time. While this plan is no longer available, LIC continues to offer other policies with similar benefits. For updated plans, consult your LIC advisor or visit the official LIC website.