LIC Wealth Plus

LIC Wealth Plus (Table No.801) is an investment plan for limited time offer!

LIC Wealth Plus Summary:

LIC’s Wealth Plus (Table No.801) is a ULIP insurance plan that protects your investment from market fluctuations so that your investments are protected in financially volatile times. Wealth Plus offers a Guarantee of the highest NAV in the first 7 years of the policy, subject to a minimum of Rs.10. The policy term is 8 years.

Wealth Plus Features:

1. Guaranteed Highest NAV of 7 years.

2. Very Attractive Returns.

3. Life cover.

Risk cover of 5 times the annualized premium or 1.25 times of single premium.

4. Minimum Yearly premium Rs. 20,000 for three years term policy and there is no limit on maximum premium.

5. Tax benefits.

6. Partial withdrawals allowed:

Two Partial withdrawals are allowed in a policy year subject to certain conditions.

7. Limited Period Offer.

8. Extended life cover:

A unique feature of the Plan is the extended life cover for 2 years after the completion of the policy term of 8 years.

9. Maturity Benefit:

At the end of the policy term and the policy is in full force, payment of fund value will be made based on the highest NAV over the first 7 years of the policy or the NAV as applicable at the end of the policy terms whichever is higher.

Death benefit:

In case of death during the policy term, the nominee shall receive Sum Assured under the basic plan together with the Policyholder’s Fund Value as a death benefit. In case of death of the Life assured after the policy term, but before the expiry of the extended period, the nominee shall receive the Sum Assured under the Basic Plan.

Accident Benefit:

Accident Benefit Option equal to the amount of life cover subject to a minimum of Rs. 50,000 and a maximum of Rs. 50 lakh is available subject to certain limits and conditions. Accident Benefit charge at the rate of Rs. 0.50 per thousand Accident Benefit Sum Assured per policy year will be levied every month.

Modes of Premium Payment for LIC Wealth Plus :

The premium can be paid either in a Single premium (One-time investment) or for 3 years regularly at yearly, half-yearly, quarterly, or monthly (through ECS).

Minimum Premium:

Minimum Premium for 3 years Premium Paying policies is Rs.20,000 p.a. whereas for Single premium policies, it is Rs.40,000 For Monthly (ECS) mode the minimum premium is Rs.2,000 p.m.

Eligibility for LIC’s Wealth Plus:

The minimum Age at entry is 10 years (age last birthday)

The maximum Age at entry is 65 years (age nearer birthday).

Premium Top-ups:

Premium Top-ups are not allowed.

Surrender Value:

LIC Wealth Plus can be surrendered only during the policy term. The surrender value, if any, is payable only after the completion of the third policy anniversary both under the Single and 3 years Premium Paying Term contract. The surrender value will be the Policyholder’s Fund Value at the date of surrender. There will be no Surrender charge. The policy can not be surrendered during the extended life cover period.

Download LIC Wealth Plus details in pdf format. For Wealth Plus Comparison table.

LIC Wealth Plus NAV:

LIC’s NAV changes every day depending on the market as it’s linked to the share market. LIC Wealth Plus is alike mutual fund scheme that focuses on long-term growth i.e. LIC Wealth Plus was launched with a 3 year lock-in period, LIC Wealth Plus also offers an option of exit after three years based on returns obtained from the scheme.

Lic Wealth Plus maturity amount calculator:

Example: If Mr. Nilesh buys Wealth Plus today at Rs.10 NAV ( He will get Approx. 4700 Units for a one-time investment of Rs.50000 *Calculated on Rs.10 NAV) and the market goes up to Rs.50 per NAV in 5 years and then again market collapse and comes down to Rs.20 In this case the highest NAV is Rs.50 and hence your maturity amount will be 4700×50=Rs.2,35,000/- (No. of units x Highest NAV)

Last Date: 9th May 2010

(Plan Discontinued)

Note:

The above is the product summary giving the key features of the plan. This is for illustrative purposes only. This does not represent a contract and for details please refer to your policy document.

Komal Jeevan

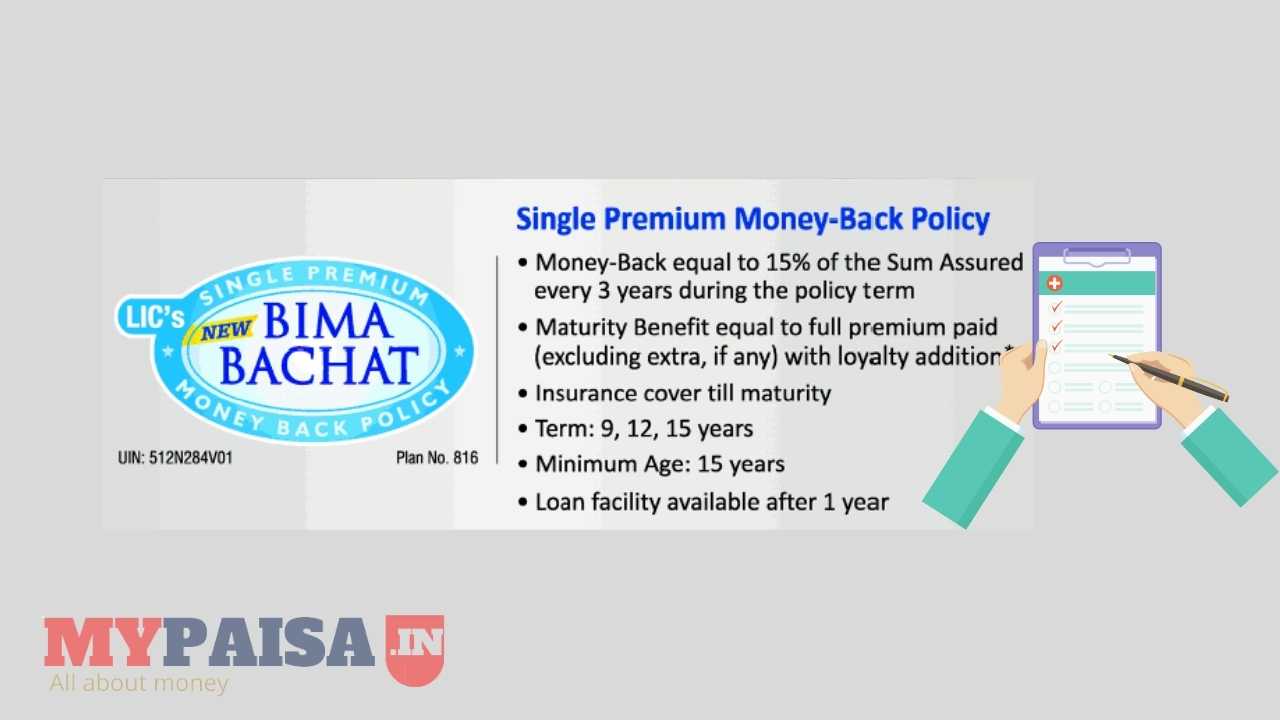

Bima Bachat

Tags: investment

give me my wealthplus policy status

table no-801

policy no.854833619

my total investmet at the date of 01/03/2010-rs 40000, at lic wealth plus.my policy no is 427948012 . what benifit get i return till today.please reply me

LIC Wealth Plus

How many numbers of units will be alloted to me ,if i have invested amount Rs 75,000.

I TOOK THE WEALTH PLUS POLICY ON 31/03/2010.POLICY NO. 538680051. MY DOB IS 15/05/1969.NOW IF I BROKE THE POLICY ,THEN HOW MANY AMOUNT LIC WILL GIVE ME.

i had paid 3 premium of rs 20000 pa in wealth plus from 15 march 2010 now on 13 may 2-13 i want to surrender all my amount so please tell me how much amount i will get

i have my wealth insurance policy and i have invested 40000 rupees in wealthplus insurance

how much i get after three years since march 2010

sir,

My relative S.Kumar is a policy holder of LIC wealth plus. his policy no is 746219126 in 801 plan and 08 term. his commencement was on 20.04.2010 with instalment of Rs.20,000/- by mode of yearly payment. He paid for three years. he would like to know the amount balance till 2013 april and also he wants to know the details of this scheme in detail.

regards,

Muhil.M

my wealthplus policy no 777887704.whether NAV above Rs 75000 or below ? clarify.

I have Wealth plus policy started on 06.05.2010 & paid 03 premiums till date of 20,000 each.

Could I surrender this policy. What could be the surrender value.

my wealth plus policy no.976922833 on date of comnsenent 22/04/2010 Plan 801 08 one time premium …… I have to withdraw the above policy so how many benifit give me.