Jeevan Surabhi

Summary:

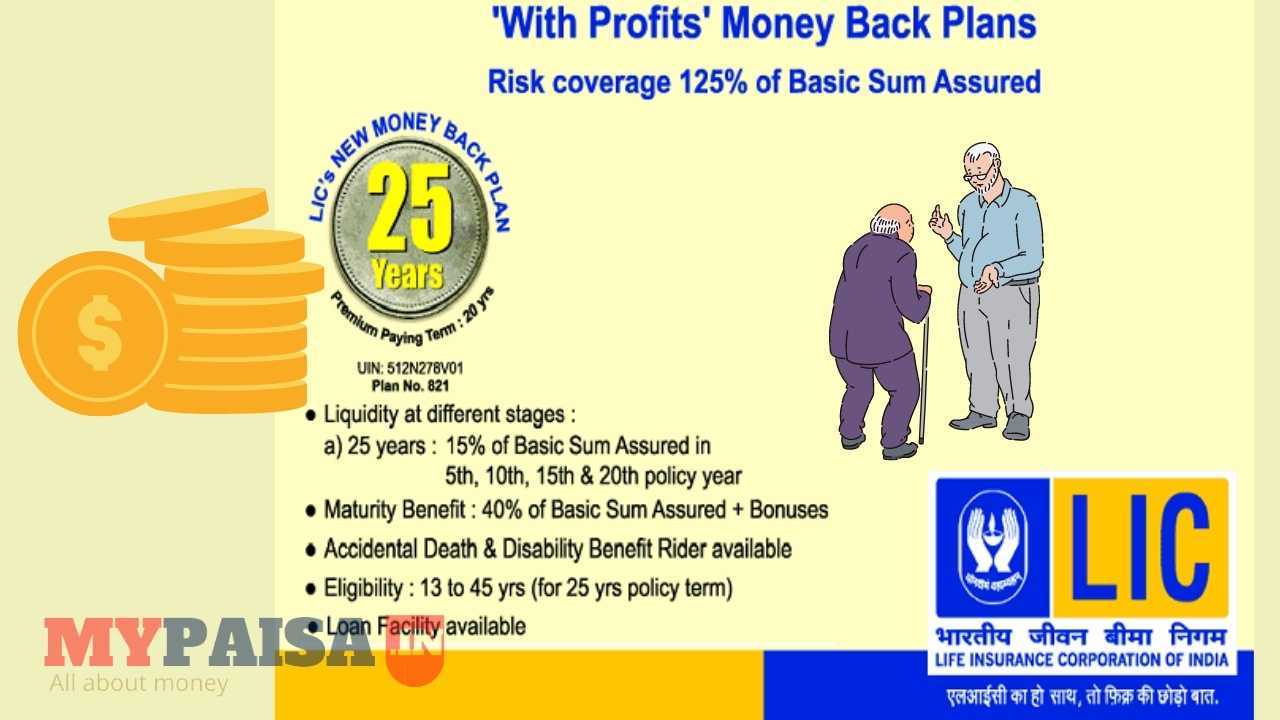

LIC Jeevan Surabhi is a money-back plan. Jeevan Surabhi’s plan is similar to other LIC money-back plans. However main differences between regular moneyback plans and Jeevan Surabhi are as the Maturity term is more than the premium paying term. Early and a higher rate of survival benefit payment. A life insurance cover is available throughout the term of the plan. Risk cover increases every five years.

Jeevan Surabhi is a with-profit plan available in 3 different terms of 15 yrs, 20 yrs and 25 years.

LIC Jeevan Surabhi policy is divided into 3 tables depending on the term (Years):

| Plan Name | Table No. /Plan No. | Term (Policy duration) |

| Jeevan Surabhi | Table No. 106 | 15 years |

| Jeevan Surabhi | Table No. 107 | 20 years |

| Jeevan Surabhi | Table No. 108 | 25 years |

- Accident Insurance:

Accident Benefit is available - Benefits:

Death Benefits:

1. Accrued bonus is paid if the policyholder dies before maturity.

2. Sum Assured risk cover increases by 50%, Once in every 5 years.

3. Already paid survival benefit to the policyholder will not be deducted from the death claim amount.

4. If insurance is financed by parent’s income up to SA of 10 lakhs then this plan is allowed to minor females.

5. Life Risk cover increases without undergoing a special medical report or medical exam. You also don’t need to pay an extra premium.

6. Accident benefit is provided only on basic SA during premium paying term.

Survival Benefits:

Survival benefit for Rs. 1 Lakh basic SA.

| Policy Term | PPT | 4th yr | 8th yr | 12th yr | 15th yr | 18 yr |

| 15 yrs | 12 yrs | Rs.30,000 | Rs.30,000 | Rs.40,000 | – | – |

| 20 yrs | 15 yrs | Rs.25,000 | Rs.25,000 | Rs.25,000 | Rs.25,000 | – |

| 25 yrs | 18 yrs | Rs.20,000 | Rs.20,000 | Rs.20,000 | Rs.20,000 | Rs.20,000 |

Money Back :

Full sum assured is paid back (Money Back) as a survival benefit by the end of the premium paying term. However, the risk cover (Insurance) and additional risk cover continue and your policy participates in profits till the end of the policy term. Jeevan Surabhi plan is suitable for professionals and Businessmen as they need money periodically.

Income-Tax exemption:

- Premium paid under section 80C of the Income Tax Act within the overall cap of Rs 1 Lakh per annum allowed for tax savings.

- On the claims received either by way of survival benefits or Maturity claims, whatever be the bonus accrued is also non-taxable.

Premiums :

You can pay Jeevan Surabhi Premiums yearly, half-yearly, quarterly, monthly, or through salary deductions.

Jeevan Surabhi Eligibility Conditions and Restrictions:

Min. age at entry: 14 years. (last birthday)

Max. age at entry:

- 55 yrs for plan 106

- 50 yrs for plan 107

- 45 yrs for plan 108

Min. Sum Assured.: Rs.50,000/-

Max. SA.: No Limit

SA in multiples: Rs. 5000

Max. Maturity age: 70 years.

Min Term: 15 yrs

Max Term: 25 years.

Modes Allowed: All

Policy Loan: Available

Accident benefit per 1000 SA: Re. 1 extra.

Form Number: 300/340

This plan is not allowed for pregnant ladies and when occupation Extra is chargeable.

Example:

Let’s assume Mr. Dilip takes Jeevan Surabhi policy for 25 years for Rs. 1 lakh with Premium Paying Term (PPT) 18 years. After 4 years, he will receive Rs 20,000 and again in the 8th year Rs 20,000. If Mr. Dilip expires during the 10th year of the policy then his nominee will receive Rs. 2,00,000 (Rs.1,50,000 as claim and Rs.50,000 as bonus at an estimated Rs. 50 per thousand p.a. for 10 years).

Update: Jeevan Surabhi Plan No.106, 107, and 108 Has Been Discontinued.

Note:

The above is the product summary giving the key features of the plan. This is for illustrative purposes only. This does not represent a contract and for details please refer to your policy document.

LIC Jeevan Suraksha 1

Tags: Money Back Plan

Please send a message about next premium due in the favour of the policy no-211349658(Ashok Kumar Mishra),policy no-215515472(my son name Adarsh Mishra)&policy no-218084227(my wife Pushpa Mishra).My mobile no-9452221734 & E mail id pashok.mishra@rediffmail.com Thanking you sir

I have taken Jeevan Surabhi policy in the year 2008 for sum assured 2lakh period 15 years.I m paying premium around Rs.21000 per year.How much net amount will i be profited at the end of 15 years through this policy.

Sir,my policy no is 570571014 of Jeevan surubhi plan 106 starting dt-29- 09-1999 we had paid premiums till 19-12-2000 can we revive the policy and get the bendfits sum assured is RS-200000 please give us the full details. Rabi Shankar Mishra

sir,

i already have a money back policy period 15years. i am paying every year RS 18600 TRU AGENT, NOW ALMOST 5YEARS PASSED, HE GAVE ME RS 30000 ON 2009. AND 2011 AGAIN HE SAID ANOTHER RS 20000 WILL GET YOU. WHAT IS THE POLICY THIS ONE, I DID NOT GET HIS IDEA, PLS LET ME KNOW, HOWMANY TYPE OF POLICY IN MONEY BACK, WHAT IS THE ANNUAL PREMIUM CHART, WHICH CHART MY POLICY INCLUDED. I AM WAITING FOR YOUR REPLY.

SUHAIL

We many money back policy. Premium depends on age and term you choose.

How much sum assured you have? Give me your policy number, I will check it. Or you can ask for account snapshot from your agent.

my birth date is 20/06/1975 i wood like to know about money back policy for 20 year plan i.e. maturity period & amount return at end annual premium , what amount i received in instalment

I have a money back policy I think it is matured near about 2012 so what amount I have received my policy period 15 year and premium quarterly Rs 1265.00

Please reply as soon as possibly

rajesh

Could you please let me know in details about the LIC plan called Market Plus. What are its benefits and returns and also the sum assurred

regards

rajesh

Hi, I am Raj sagar. In the above jeevan surabhi policy, in thev example provided, the sum assured money is misprinted as 20 lakhs, I think it should be 2 lakhs. Please make necessary corrections so that customers don’t get stunned with such type of figures! Hope corrections will be made ASAP! Thank you.

Fixed… Thanks

sir i am confused some agent told me that in lic surabhi 15 yrs plan the annual premium will be 10900, i will get 30000 after four yrs, 30000 again after eight years, 40000 after twelve years and after that a sum of rs 80000 after 15 yrs and the toher agent told me the sum after 15 yrs will be 200000…which one is true???? my dob is 24/06/1978…waiting for ur valuable suggestion.thanks

Dear sir/Madam

I am interestted in” LIC jeevan surrbhi” monay back plan.my

12years.my deathof birth 18-04-1982.will you provide me premium payment details? how much i have to pay yearly basis premium?

thank

aftab alam