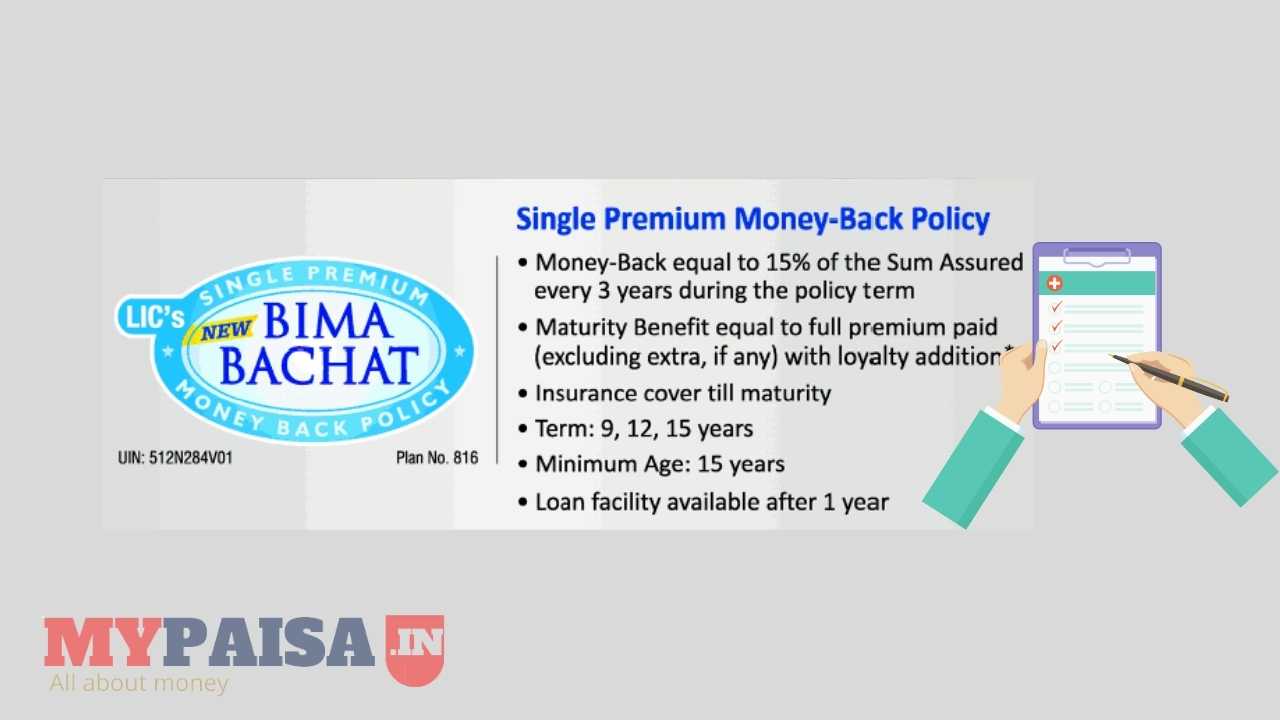

Bima Bachat Summary:

LIC Bima Bachat (Table No.175) is a single premium money-back policy. Bima Bachat offers financial security and assurance to the policyholder and his family.

Benefits:

Death Benefits:

During the Term of the policy, if the Life Assured is dead, apart from survival benefits if any, paid earlier, an amount equal to SA will be paid.

Survival benefits:

Survival benefits (15% of SA) are paid at the 3rd, 6th, 9th & 12th policy year respectively depending on the policy term. On maturity, the single premium paid along with Loyalty addition if any will be paid back.

Maturity Benefit/Survival benefit for 2 lakh SA: (30yrs age)

| Policy Term | 3rd Year | 6th Year | 9th Year | 12th year |

| 9 years | 60,000 | 60,000 | Final Maturity | – |

| 12 years | 60,000 | 60,000 | 60,000 | Final Maturity |

| 15 years | 60,000 | 60,000 | 60,000 | 60,000 |

Eligibility Conditions and Restrictions LIC Bima Bachat:

Min. age at entry: 15 years (completed).

Max. age at entry: 66 years (Nearest).

Min. S.A.: Rs. 20,000

Max. SA.: Any Amount.

SA in multiples: Rs. 5000

Max. Maturity age: 75 years (Nearest).

Terms Available: 9, 12, or 15 years.

Modes Allowed: All

Dating Back @ 8%: Allowed

Term Rider Option: Not available

Critical Illness Rider: Not available

Policy Loan: Available

Surrender Values:

The Bima Bachat can be surrendered after 1 year. The Guaranteed Surrender Value is equal to 90% of the single premium paid excluding the extra premium paid and the survival benefits paid earlier.

Bima Bachat Examples:

Let me give you an example to understand this policy. Mr. Dilip aged 30 years takes a Bima Bachat Policy for 15 years term for Rs 2 lakhs SA. He pays a single premium of Rs. 1,48,322. He receives Survival Benefit of rs 30,000 each at the end of 3rd, 6th, 9th & 12th year respectively. On Maturity, he will receive Rs 1,48,322 being the single Premium paid by Dilip. Thus total amount received by him will be Rs 2,68,322 (Rs 1,20,000 as Survival Benefits + 1,48,322 as single Premium paid) + LA if any. If Mr. Dilip dies during the 13th policy year, his nominee will get Rs 2 lakh as SA as a death benefit (Survival benefit of Rs 30000 each received during 3rd, 6th, 9th & 12th year will not be deducted from the SA). hence the total amount received would be Rs. 3,20,000.

Tax benefit (Updated)

Any life insurance policy except pension plan issued after April 1, 2012, should have risk cover of at least 10 times the annual premium to be eligible for the tax benefit under section 80C and section 10(10D) of income tax act 1961. For example: if your annual premium is Rs.10,000/- then your basic sum assured should be min. Rs.1 lac to be eligible for tax benefit.

Cooling off period:

If you are not satisfied with the “Terms and Conditions” of the policy, you may return the policy to Life Insurance Corporation Of India within 15 days.

Update: Bima Bachat has been discontinued.