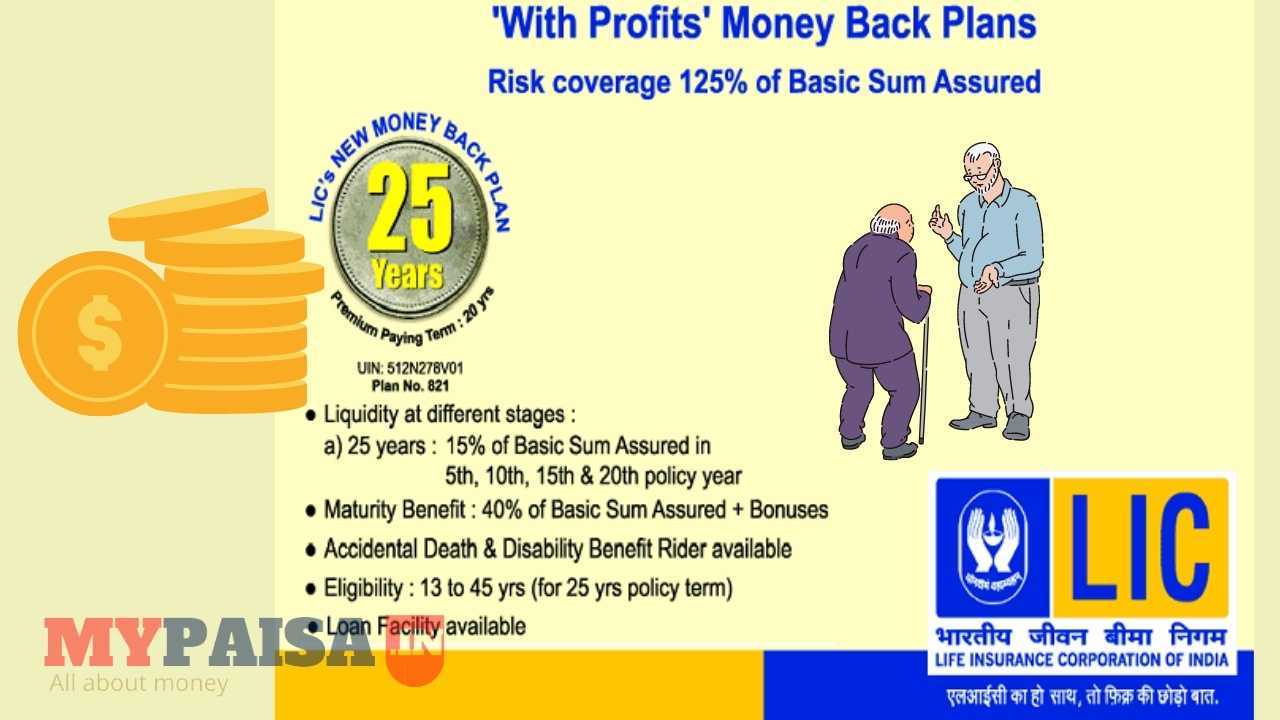

New Money Back Plan 20 years Plan no. 820 is a non-linked money-back insurance plan. That means, it is free from the market risk also provides participation in the profit of the corporation. It provides protection against the unfortunate death of the policyholder in addition to it, it provides survival benefit at the end of every 5 years of the policy term. It also provides maturity benefit in case of policyholder survives throughout the policy term.

Features and details of LIC new money back plan 20 years

- It is a non-linked participating money-back insurance plan that provides a guaranteed return.

- The minimum sum that can be assured is one lakh and there is no maximum limit for the sum assured.

- The minimum age for the entry of this plan is 13 years and the maximum age for the entry of this plan is 50 years.

- The policy term equals 20 years.

- The maximum age at the time of maturity of the life assured is 70 years.

- The premium paying term is 15 years.

- The mode of premium paying term can be annual, half-yearly, quarterly, or monthly.

- There is a grace period of 30 days provided for premium payment of annually, half-yearly and quarterly mode of payment and 15 days for monthly mode of payment.

- The policy can be surrendered after the completion of 3 years of the premium paying term.

- In case of the policyholder stops paying premium then the policy will be terminated. In the case of the premium has been paid for 3 years only the policy gets a paid-up value.

- LIC’s new money-back plan can be revived within 2 years of the last premium paying date.

Benefits provided under LIC new money back plan 20 years

Death benefit

If the policyholder made to death within the policy term then the nominee will get the sum assured on death as a death benefit. The sum assured on death is 10 times the annualized premium or 125% of the basic sum assured plus a simple reversionary bonus and final additional bonus if any. The periodical survival benefit which has been provided to the policyholder will also not get deducted from the sum assured.

Maturity benefit

In case of policyholder survives throughout the policy term then the maturity benefit will be provided to the policyholder. That will be 40% of the basic sum assured plus a simple reversionary bonus and a final additional bonus.

Survival benefit

There is a survival benefit provided at the end of each fifth, tenth, and fifteenth years of the policy. Survival benefit is 20% of the basic sum assured.

Tax Benefit

According to Income tax act 80C. The premium which is paid to this plan is tax-free and as per section 10 D, the maturity amount is also tax-free that means you can file an income tax return on the amount which is paid as the premium.

Accidental death and disability benefit

These benefits can opt for the payment of an additional premium as an add-on policy. This provides additional benefits in case of accidental death or disability caused due to accident. It can be taken after attaining the age of 18 years of the policyholder.

Documents required for LIC new money back plan 20 years

- Fully filled application form with photographs

- Age proof of policy buyer.

- Address proof.

- PAN card and Aadhar card for KYC document

- Accurate medical history

- Medical examination report if required.

Other information that the policy buyers should know.

Cooling off period

After purchasing the policy if the policy buyer is not satisfied with the policy then within 15 days the policy can we return after the receipt of the policy document.

Discounts

There is a discount allotted on the half-yearly and early mode of premium payment. 1% for half yearly premium payment and 2% for early premium payment.

Loan.

The policyholder can take a loan up to the premium amount if the policy attains a surrender value after the completion of three years of policy paying term. As per the terms and conditions of the corporation.