LIC New Bima Gold Plan (Plan No. 179) is a unique money-back insurance policy from the Life Insurance Corporation of India, blending the security of traditional endowment plans with the added benefit of money-back returns. Designed for individuals seeking a combination of financial protection and savings, this plan offers valuable coverage for policyholders and their families, even after policy maturity.

Key Features of LIC New Bima Gold Plan

LIC New Bima Gold Plan provides several distinctive features that make it a valuable choice for policyholders.

Auto-Cover Facility

With the Auto-Cover Facility, policyholders receive extended coverage even after missing premium payments:

- If at least two years of premiums have been paid, full death cover continues for up to two years from the date of the first unpaid premium (FUP) or until the policy term ends, whichever is earlier.

Flexible-Premium Payment Options

LIC New Bima Gold offers flexible payment modes for added convenience:

- Premiums can be paid yearly, half-yearly, quarterly, or monthly (via ECS), accommodating diverse financial needs and preferences.

Extended Coverage After Policy Term

This plan includes an extended term that provides life coverage even after the policy term concludes:

- Policyholders are covered for an extended term that’s half the length of the original term, offering 50% of the sum assured as life coverage during this period.

Benefits of LIC New Bima Gold Plan

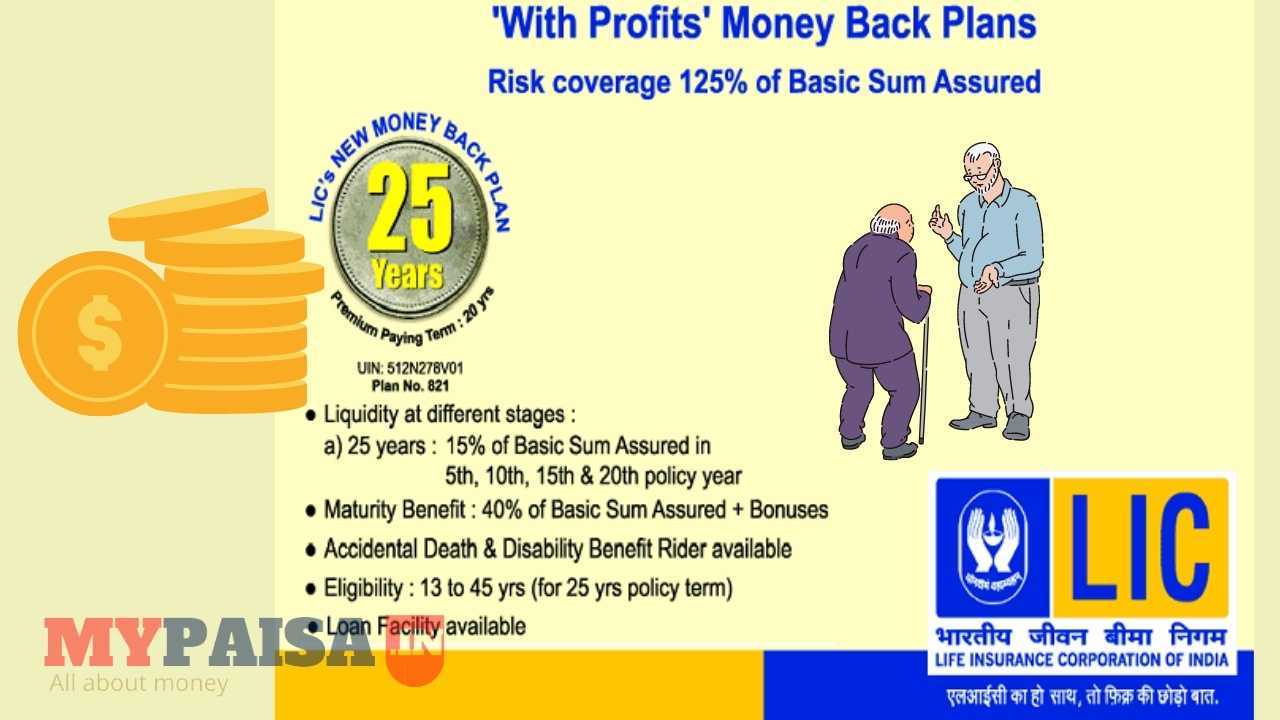

Survival Benefits

Survival benefits are payable at specific intervals if the life assured survives through the policy term. The percentage of the sum assured paid varies by policy term:

- 12-Year Term: 15% of the sum assured at the end of the 4th and 8th years.

- 16-Year Term: 15% of the sum assured at the end of the 4th, 8th, and 12th years.

- 20-Year Term: 10% of the sum assured at the end of the 4th, 8th, 12th, and 16th years.

Death Benefit

This plan ensures financial protection for the policyholder’s family:

- During the Policy Term: The full sum assured is payable in case of death while the policy is active.

- During the Extended Term: If death occurs during the extended period, 50% of the sum assured is paid, provided all premiums were paid during the policy term.

Maturity Benefit

On policy maturity, the plan provides a return of premiums, ensuring robust financial support:

- Policyholders receive the total premiums paid (excluding extra or rider premiums) minus the survival benefits already paid, along with any Loyalty Additions if applicable.

LIC New Bima Gold Plan Eligibility Criteria

Here’s a quick overview of the eligibility conditions for LIC New Bima Gold:

| Feature | Minimum | Maximum |

|---|---|---|

| Entry Age | 14 years | 57 years (for 12-year term), 51 years (for 16-year term), 45 years (for 20-year term) |

| Policy Term | 12, 16, or 20 years | – |

| Sum Assured | Rs.50,000 | No upper limit (in multiples of Rs.5,000) |

| Extended Coverage Age | – | Up to 75 years |

Additional Information on LIC New Bima Gold Plan

Cooling-Off Period

Policyholders can use the 15-day cooling-off period to return the policy if they’re unsatisfied with the terms and conditions.

Tax Benefits

The premiums paid under this plan are eligible for deductions under Section 80C of the Income Tax Act. Additionally, the maturity proceeds are tax-free under Section 10(10D), offering tax-efficient returns.

Loan Facility

A loan can be availed against this policy after paying 3 full years’ premiums, making it easier to access funds in times of need.

Riders for Extra Protection

Policyholders can enhance their coverage by adding optional riders, such as:

- Accidental Death Benefit Rider

- Disability Benefit Rider

These riders provide added financial security against unexpected events, making the policy more comprehensive.

Frequently Asked Questions (FAQs)

Q1: What is the minimum sum assured under LIC New Bima Gold Plan?

A: The minimum sum assured is Rs.50,000, with no upper limit (in multiples of Rs.5,000).

Q2: Can I apply for a loan against my LIC New Bima Gold policy?

A: Yes, a loan facility is available after three full years of premium payments.

Q3: Is there a tax benefit on LIC New Bima Gold Plan?

A: Yes, premiums qualify for tax deductions under Section 80C, and maturity benefits are tax-free under Section 10(10D).

Q4: What happens if I miss a premium payment?

A: If at least two full years’ premiums have been paid, the policy will still provide death cover for up to two years from the first unpaid premium date.

Q5: How can I maximize my returns with LIC New Bima Gold?

A: Ensure timely premium payments and consider adding riders for enhanced protection.

Conclusion: Is LIC New Bima Gold Plan Right for You?

LIC New Bima Gold Plan offers a valuable combination of savings and life insurance with the added flexibility of survival benefits and extended coverage. With its tax advantages and optional riders, this plan is an excellent choice for individuals seeking long-term financial security. For further guidance, contact an LIC representative or visit the official LIC website to learn more.