LIC New Children’s money back plan no. 832 is proposed by the LIC of India to secure the future of the child. Even the parents are not there, it provides benefits at the various stages of the life of a child also provides life protection of the child in the form of insurance coverage. It is a non-linked participating money back plan, It provides survival benefits to the child at the age of 18 years 20 years, and 22 years. One can buy this policy for the future of his child, such as his higher study, marriage, etc

Features of LIC new children’s money back plan

- It is a non linked endowment plan that means it is protected from the ups and downs of the market

- It is a participating endowment plan that means it provides benefit as per the experience of the corporation

- This plan can be taken for any child between the age 0 to 12 years by parents or grandparents

- This is a limited premium paying endowment plan that means the policyholder should not have to pay the premium each year of the policy term.

- It provides various benefits such as survival benefit, maturity benefit, and death benefit including this there are also some additional benefits.

Benefits provided under LIC new children’s money back plan

Survival benefit

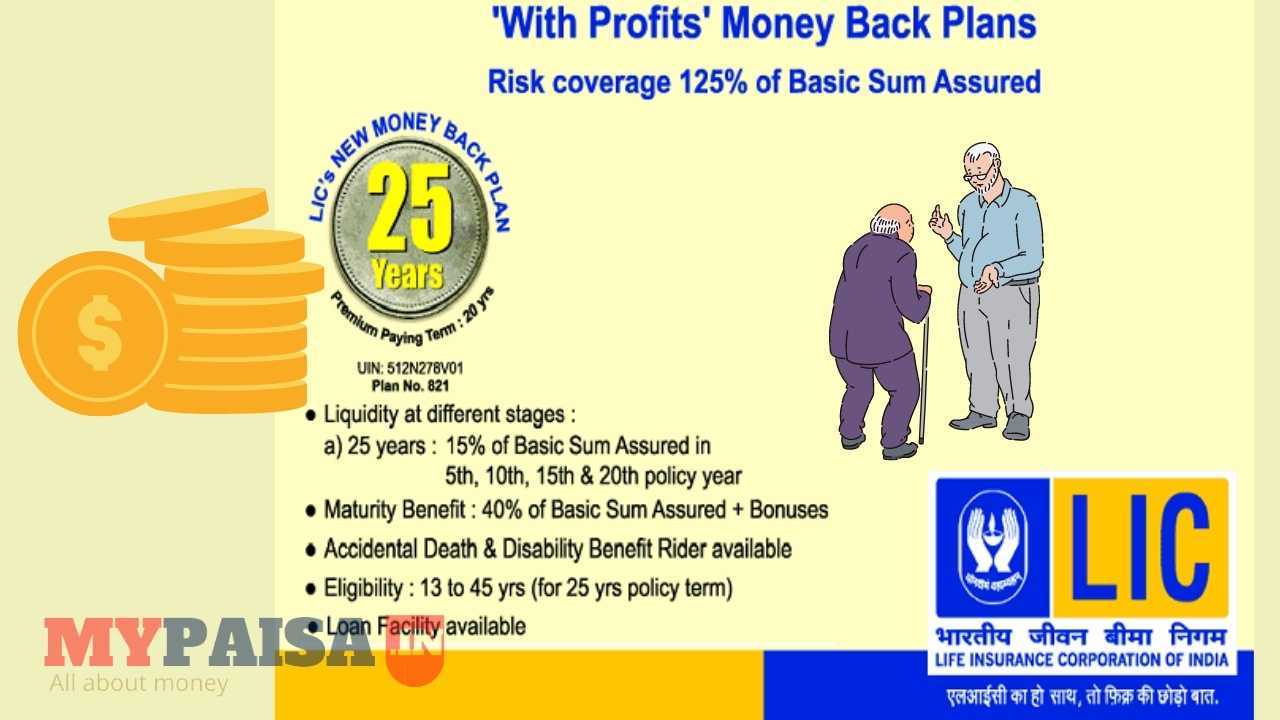

The corporation provides survival benefits to the child when he attends the age of 18 years 20 years and 22 years. 20% of the sum assured is given on each occasion.

Maturity benefit

In case of the maturity of the plan, the 40% of the basic sum assured plus a simple reversionary bonus plus a final additional bonus if any is payable to the child.

Death benefit

If the life assured meet to death before the commencement of the risk. The premium is paid till that time is returned.

In case of the assured life meet to death after the commencement of the risk sum assured on death plus simple reversionary bonus plus final additional bonus is payable to the nominee of the policyholder.

Tax benefits

The premium paid under LIC new children’s money back plan is tax-free as per section 80 C and the claim which is received by the Corporation is also tax-free under section 10D of the Income Tax Act.

Eligibility criteria detail of LIC new children money back plan

- The minimum date for the entry of this plan is zero years and the maximum age for the entry of this plan is 12 years.

- The maximum age at the time of maturity of the policy is 25 years.

- The policy term is 25 years.

- The premium paying term is 5 years less than the policy term. Such as, if the policyholder takes a policy for 12 years then he will have to pay the premium for 7 years only.

- The policy can be paid annually, half-yearly, quarterly, or monthly

- The minimum sum that can be assured 1 lakh and there is no maximum limit for the upper level of the sum assured.

Documents required for LIC new children’s money back plan

- Fully filled application form with photographs

- Age proof of policy buyer.

- Address proof.

- PAN card and Aadhar card for KYC document

- Accurate medical history

- Medical examination report if required.

Other information that the policy buyers should know.

Cooling off period

After purchasing the policy if the policy buyer is not satisfied with the policy then within 15 days the policy can be return after receiving the policy document.

Discounts

There is a discount allotted on the half-yearly and early mode of premium payment. 1% for half yearly premium payment and 2% for early premium payment.

New Children’s Money Back Plan Ready Reckoner Premium and Maturity Details

Loan.

The policyholder can take a loan up to the premium amount if the policy attains a surrender value after the completion of three years of policy paying term. As per the terms and conditions of the corporation.