You might have heard about eKYC but have you heard about Central KYC? why and where you need to fill the form? What’s your benefit? I will share A to Z of cKYC here in this article.

What is cKYC?

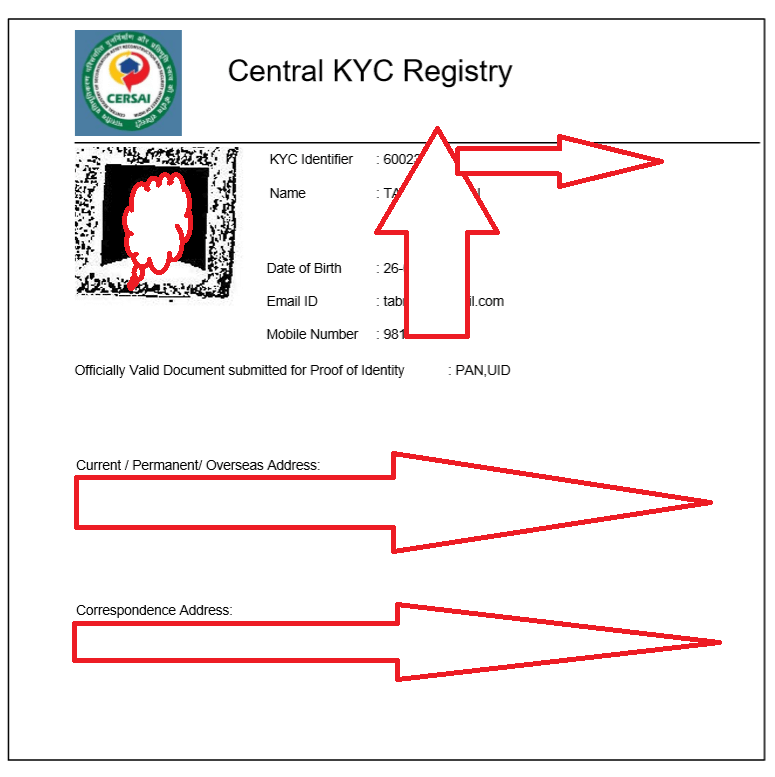

Centralized KYC is the central record to keep your KYC safe and validate with other organizations when and as needed without submitting the KYC document to every company. Once you have completed the cKYC you will get the 14 digit KYC Identifier number which can be given in any financial organization to complete your KYC. cKYC is like Adhar for Financial KYC.

CERSAI: Agency Behind CKYC

The Central KYC (Know Your Customer) database is maintained by the Central Registry of Securitization Asset Reconstruction and Security Interest (CERSAI). CERSAI is the Central KYC registry authorized by the Central Government to act as a regulatory body and fulfill the responsibilities of the Central KYC Records Registry under the Prevention of Money-Laundering Act, 2005. CKYC involves collecting, saving, securing, and retrieving the KYC records of an investor in the digital form at the central level you don’t have to submit your KYC again in all the financial organizations. This cKYC can be used in all banks, Mutual Fund organizations, Insurance companies, etc.

Motive of cKYC

The motive of centralized KYC is to bring transparency in the investment and financial sector. This will eliminate Adhar and PAN card verification. All you need is a 14 digit CKYC Identifier and your financial institution will pul your KYC from the server.

Where can cKYC be used?

Currently, this can be used in Banks, Insurance companies, Mutual Fund Companies, etc.

Who can access CKYC?

Only a registered financial institution’s authorized person will be able to retrieve your CKYC.

What data will be available in CKYC?

Primarily it will have 14 digits KYC Identifier, your full name, date of birth, Email address, Phone Number, Permanent address and correspondence address. If you need to change or update any data in cKYC, you need to approach the Registry and submit the form to update the data in the system.

Types of KYC

KYC: This is normal KYC where you submit your documents manually to an organization when they demand KYC.

eKYC: This is Adhar based electronic KYC, widely used in the Telecom sector to validate their customers by Biometric Identification or OTP Based verification.

CKYC: This is a new kind of centralized KYC. This has to be done once and will work for multiple companies.

Documents Required for cKYC

For Central KYC you need to submit the following documents:

- Filled and signed cKYC form

- ID Proof self-attested

- Residence Proof self-attested

- 1 photograph

If you have submitted your KYC in any financial institution it is most likely that they will fill and submit the CKYC on your behalf and you will receive the notification on your email address.

Types of CKYC

Normal KYC

This is a simple KYC. You can submit any of these official documents.

- PAN card

- Aadhaar card

- Driving license

- Passport

- NREGA Job Card

- Voter Id card

Simplified or Low-Risk KYC

If you can not submit any of these official document you can have the Low-Risk KYC without giving any of the official documents above. This Low-Risk Profile will carry L prefix in their KYC Identifier number.

You need for furnish any of these document:

Photo Identity card issued by state govt / central govt, public sector undertakings (PSUs), legal/administrative authority, public financial organizations, and scheduled commercial banks. if a person doesn’t have the above ID proof they can also submit a Letter with a duly attested photo of the person issued by a gazetted officer.

Small KYC

If you can’t produce any of the documents above and do not qualify for Low-Risk KYC, you can apply for Small Account. This small account will have S prefix to their CKYC Identifier number and this will have some limitation. For example

- Upto Rs,1,00,000 credit limit in a year.

- Upto Rs.10,000 withdrawal in a month.

- Upto Rs.50,000 account balance at any time.

You can not exceed these limits in small KYC.