Did you know?

- Algorithms execute more than 80% of trades on the NYSE and 40% on the NSE.

- A 2019 study explains that forex algorithmic trading accounts for 92% of transactions.

The above cases serve as evidence of the impact this new technique to trading i.e algorithmic trading is having in India. Going further, algorithmic trading has the potential to completely transform the Indian markets and the approach to trading among individual and retail traders.

All traders must develop an algorithmic competitive edge in the market in light of the aforementioned pieces of evidence or predictions. With today’s technology, financial know-how, and market understanding, they will be able to quickly diversify their areas of expertise, alter their trading style to keep up with trends, and compete in the market.

A brief intro to Algorithmic Trading

Algorithmic trading is also known as black-box trading or simply algo trading. It is the process of placing orders in the market based on a specific trading logic via online trading terminals, which execute the instructions generated by various trading algorithms.

In simple terms, it uses a defined set of instructions in the form of an algorithm to generate trading signals and place orders. Each algorithm can be assumed to have access to current and historical prices of instruments that can be bought and sold after performing computations based on the prices. The algorithm may even split the order into small pieces and execute them at different times to get the best possible prices.

The evolution of trading in India

Algorithmic trading entered the Indian markets in 2008 when the SEBI introduced and legalized the use of algorithms to execute trades. Due to its benefits, including the ability to execute multiple transactions at once, direct market access, minimal human intervention, etc., this new trading strategy attracted and gained popularity among many institutional traders.

Trading games have evolved in India as a result of advances in financial engineering that allowed trades to be automated. By making the DMA platform available to foreign institutional investors on July 24, 2009, SEBI took a further step to promote algorithmic trading (FII).

This aided brokers in increasing trading efficiency and synchronizing with exchanges and markets around the world. To protect the integrity of traders and lessen malpractice, a special set of laws and regulations were developed.

Coherent Market Insights predicts that the global Algorithmic Trading market would surpass US$ 21,685.53 Million by 2026.

Technical requirements for Algo Trading in India

A few technical prerequisites that traders must meet before engaging in algo trading, such as:

- To develop and execute algorithms on various trading platforms, programming skills, and technical knowledge are required.

- Access to live market data is essential.

- The availability of historical data is crucial because backtesting is the foundation of effective algo trading.

- Backtesting and trade execution using trading algorithms requires an appropriate infrastructure.

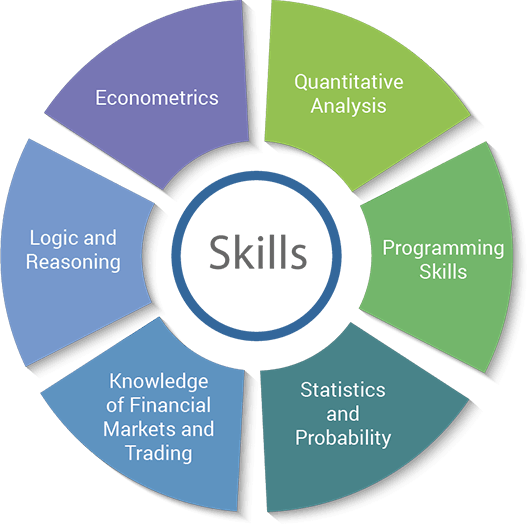

Skills required for Algo Trading

Algorithmic trading is the most common type of Automated trading in Indian markets. It helps traders to create algorithms that are set up to trade on their behalf based on pre-programmed instructions. There are many advantages that algorithmic traders enjoy.

But one needs to have a specific set of skills or abilities before beginning algorithmic trading.

Source: QuantInsti

Analytical skills

Analytical skills are necessary to become a successful trader or a professional quant trader.

Mathematical skills

Algorithms, historical/current data, and programming are the three main components of algorithmic trading. In order to be hired by an algo trading or high-firm trading firm, a person must also possess mathematical proficiency.

Programming skills

Algorithm development requires a very solid understanding and proficiency in programming languages like Python, C++, and R. Python for trading has become increasingly popular among traders due to its benefits, including the fact that it is free to use and has incredible libraries. Both backtesting and strategy conception benefit greatly from the use of Python.

Knowledge of the Financial Markets

Algo trading involves dealing with enormous financial datasets, engaging in international financial markets, using technical indicators, analyzing chart patterns for forecasting, etc. Because of this, it is crucial for every trader to be properly informed about and comprehend market trends.

Factors to consider while trading algorithmically

Several factors to consider and keep in mind when developing algo trading strategies such as

- To leverage the market, don’t forget to backtest your trading strategies and analyze the benefits and drawbacks of the algorithms.

- Use historical data, and technical indicators, have a thorough understanding of the market’s current state and keep up with new technological developments when conducting proper market research.

- Find a trustworthy data vendor.

- Trade leveraged products with extreme caution.

- Always paper trade before going live with your trading approaches

Regulations

One must be aware of the regulations and the law of the land. In India, the regulating body is the Securities and Exchange Board of India (SEBI). To prevent issues, regulatory authorities and exchanges, like the BSE and NSE, have invested significantly in technology and relevant regulations, like risk and collateral controls.

Facilities

Different exchanges usually offer multiple facilities. In India, both major equity exchanges currently offer co-location services, and there is intelligent order routing between these exchanges. As a result, the Indian market is ready for advanced market competition in the future.

Why practice Algorithmic Trading?

Here are a few reasons why you should learn and practice algo trading.

- Segregates human emotions from trading

- For algorithmic trading strategies, both the number of instruments and the execution size of orders are scalable

- It is not necessary to continuously monitor the market

- Enhanced speed

- You can evaluate current and historical quantitative data and act quickly in any situation.

- Best-priced trades are executed

- Stocks can be traded around 24 hours a day

In addition to being a solution, algorithmic trading offers businesses and organizations an advantage in managing their cash flow. It maximizes the capital allocation strategy by investing in better opportunities at the right time.

Conclusion

Although algorithmic trading was not invented in India, it has gained popularity since SEBI allowed the equity markets to use cutting-edge technology. To conduct financial maneuvers, traders now have access to algorithmic trading platforms, tools, and software.

An innovation in trading is algo trading. It makes use of AI, ML, NLP, cloud, etc. to build strategies and achieve the best results. Algo trading has also accelerated the evolution of traders and their trading strategies. Traders use mathematical and statistical models to develop strategies that increase the scope.

As a result, trading innovations force traders to continuously learn about and adjust to their surroundings. A variety of innovations drives the industry, so it is crucial to develop skill sets. Traders must also be aware of the technologies and elements that affect their operations. This algo trading course can aid traders in successfully expanding their skill sets.