We’ve all heard of the term “good CIBIL score” and, if you are reading this article, it is likely that it has been important to you. What exactly does a good credit score entail? And how do I go about improving my own personal CIBIL score? These are questions we will answer for you today!

There are four main aspects that make up your CIBIL score:

- Payment history (35%)

- Outstanding balance (30%)

- Length of time with current lender (15%) and

- Types of credit used and other factors (20%)

What is CIBIL Score?

Learn the basics of CIBIL Score, how it is calculated and what factors determine your score. Ways to improve your credit score. CIBIL stands for Credit Information Bureau of India Limited. It is a credit information company in India.

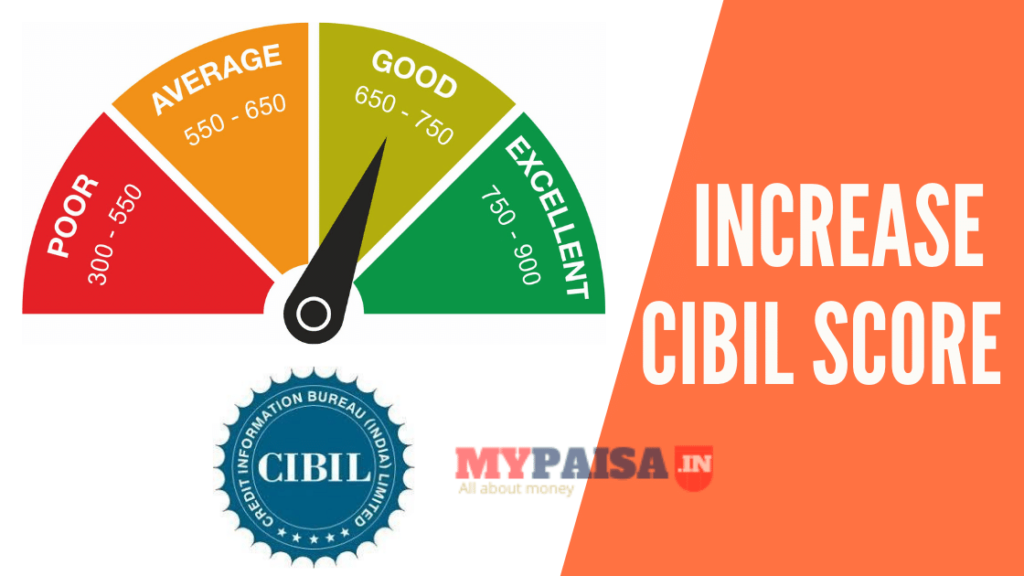

CIBIL Score is the numerical representation of your financial status that banks, NBFCs, etc use to check your eligibility for loans and other products they offer. A higher CIBIL score means a better credit history with minimum defaults and a greater chance of getting a loan. All the bank checks your CIBIL score before approving your loan. The CIBIL score can be as high as 900. If you have a 700+ CIBIL score, your chances of getting a loan are easier.

CIBIL Score is made up of data from public sources like banks, credit card companies, NBFCs, etc. CIBIL also uses information from private sources to calculate your score.

It’s important to keep your CIBIL score high at all times. To do that, you need to take care of the following things:

1. Check your CIBIL Score regularly

You can check your credit score online. You can add it as an app on your phone too. Either way, having quick access to information about your credit history. There are various third-party companies too who provide you with a free CIBIL report.

2. Check your statement of accounts regularly

You must check your credit card/loan statements as often as you can. You may not like the bill but if there is an error in it, you’ll know about it right away.

3. Pay off your bills in time

The biggest mistake most people make is not making timely payments of their bills. Due to which they get charge-off and/or bad loans against their name. If you pay your bill late, it lowers your CIBIL score. If you frequently forget your due dates, set up automatic payments to creditors and utility companies.

Cut back on the amount of debt you have, avoid applying for new lines of credit, and pay off existing debt as quickly as possible.

Also, make sure to pay off your Credit Card bill in full. Paying the minimum amount will affect your CIBIL score.

4. Try to keep your balance low on all your cards

The bigger your credit card limit is, the more you can spend and the higher risk you are for banks, etc. The concept of revolving around a monthly limit also comes into play here. If you prefer paying cash for everyday expenses, only a small portion of the total balance should be outstanding on any one card at any given time. There is a statistical correlation between your credit score and the average balance you carry. Never utilize more than 50% of your available credit on your credit card.

5. Don’t let account age affect your CIBIL Score

If you have an account that has been active for a long time, it will show up as a positive point in your CIBIL report. On the other hand, if you have a lot of accounts that are less than one year old, it will be on your CIBIL report as a negative point. So make sure that most of your account is at least 2 years old.

6. Protect yourself from identity theft and frauds

If someone steals your credit card or debit card information and uses it to purchase a product or service, it will appear as a negative point in your CIBIL report. You will file a dispute with your credit card bank and it will take a longer time to resolve.

7. Don’t apply for anything that’s not needed

Don’t go and apply for something when you don’t really need it, especially if there is high competition to get that product or service. For example, if you have a good CIBIL score except for one card that has been maxed out and charged off, then don’t waste your time applying for other credit cards until you clear the debt on another credit card.

8. Try to maintain the same financial institution for a long period of time

Maintain older credit cards to lengthen credit history. It doesn’t matter whether you’re doing business with a bank or NBFC, it’s good for your CIBIL score if you maintain it for a long period of time. If you want to change the bank or NBFC, try to close one account first before opening another account with the same bank or NBFC. This will help improve your CIBIL score in the near future.

9. Multiple credit cards

If you have multiple credit cards, don’t use them for business purchases, your CIBIL score may be affected. Now, let me explain it. You’re running a business and you need to make some urgent expenses, in that scenario, if all your credit cards are used then it will be considered a negative point against your name. As here there is no future income to pay off so banks and NBFCs will charge high-interest rates to you. Make sure that if you have multiple credit cards then use only one at a time for expenses.

10. Try to fix your problem before it get worse

If you have a negative point against your name, try to fix the problem before it gets any worse. If it is a charge-off or a bad loan then start paying if you want to clear that delinquency and in order not to affect your CIBIL score.

Cut back on the amount of debt you have, avoid applying for new lines of credit, and pay off the existing loans as quickly as possible.

11. Watch out for scams that offer a quick fix to improve your credit score

There are many websites and other sources that promise to improve your credit score if you pay them a certain amount of money. I would suggest staying away from these, as there is no quick fix for improving a bad CIBIL score.

12. Avoid taking too many loans at a time

Avoid taking multiple small loans at the same time. Instead, apply for one big loan from one bank.

13. Opt for credit limit increase on your cards when offered

If your bank offers credit limit enhancement then go for it. The more credit limit you will have the less percent of credit utilization it will show your score healthy.

14. Pay off your highest interest rate loans first

If you have two loans with different interest rates, pay off the loan with a high-interest rate first. Paying off your highest interest rate loan will help you save some more money to keep your financial health better.

FAQs

What does CIBIL score 1 mean?

CIBIL scores range from 0-900. CIBIL score 1 means there is no data available for the given PAN card.

How can I check my cibil score for free?

You can check your CIBIL score for free from WishFin.com and other third-party sites.

What is cibil full form?

CIBIL stands for Credit Information Bureau (India) Limited

What can we do to increase CIBIL score?

Pay your credit cards and EMIs on time. Always pay credit cards in Full. Do not opt for multiple small loans.

What is a good cibil score?

CIBIL Score 900 is at the top of the list and is considered a very good score. 800 CIBIL score is considered best 700+ is considered as good. Your CIBIL score depends on your payment history, so you must make sure that you always pay off your dues in time to improve your CIBIL score.

How to check cibil score online?

You can check your CIBIL Score from here – Check Cibil Score Online. You can also check your CIBIL credit report with the help of this website.

It is important to monitor your CIBIL score and take steps to improve it. If you have a low CIBIL score, then there are several things that you can do in order to increase the likelihood of approval for loans or increased the credit limits on cards. A good way to start improving your CIBIL Score is by checking reports regularly and staying away from scams that promise quick fixes.