LIC Child Future Plan

LIC Child CAREER Plan Table 184 & Child Future Plan Table 185

When it comes to your child’s career and future, you don’t want to take risks. Every parent wants to give their child the finest education and future. If you want to secure your child’s future then this is the best LIC plan for your child. LIC has two best Children’s Plans – LIC Child’s Career Plan and Child Future Plan. Both child plans are available for the age group of 0 to 12 years.

Features:

The unique features of the twin plans are the commencement of risk from the age of 5 years of the child subject to deferment period of 2 years, auto risk cover in case of non-payment of premiums for 2 years, and free risk cover equal to the sum assured during the extended term of 7 years from the date of maturity.

Premium Waiver Benefit (PWB)

Premium Waiver Benefit rider, can be availed of which waives the payment of future premiums falling due in the event of unfortunate death of the proposer during premium paying term. Premium Waiver Benefit is also available during 2 years’ auto cover period.

Premium:

You can pay the premium monthly, half-yearly, or yearly.

Tax Benefit:

The tax benefit is available under section 80C of the Income Tax Act within the overall limit of Rs 1,00,000 per annum along with other investments allowed under the same section.

Child’s Future Plan

Under Child Future Plan (Table 185) first, money-back installment amounts to 25% of sum assured followed by 4 annual installments @ 10% of sum assured and 50% of sum assured + vested bonus, and terminal bonus if any is payable on maturity. Thus total returns being 115% of the sum assured + vested bonus & terminal bonus if any.

115% Survival benefit:

- 5 yrs before the expiry date of policy term: 25% of the SA

- 4 yrs before the expiry date of policy term: 10% of the SA

- 3 yrs before the expiry date of policy term: 10% of the SA

- 2 yrs before the expiry date of policy term: 10% of the SA

- 1 yrs before the expiry date of policy term: 10% of the SA

on the expiry date of policy term:

- 50% of the S.A + Vested simple reversionary bonus + final additional bonus (FAB, if any.

Eligibility condition for LIC Child future plan:

- Min. age at entry: 0 year (lbd)

- Max. age at entry: 12 years (lbd)

- Min. S.A.: Rs. 1 lakh.

- Max. SA.: Rs 1 crore.

- SA in multiples: Rs. 5,000

- Min. Maturity age: 23 years.

- Max. Maturity age: 27 years.

- Modes Allowed: Yly/Hly/Qly/SSS

- Policy term: 11 to 27 years

- Max. Age end of PPT: 70 years (nbd).

- Premium paying Term: 6 years OR Term minus 5 years.

- PWB Prop. Age Min: 18 years completed.

- PWB Prop. Age Max: 55 years (nbd).

FAQ:

Who can take this policy?

Ideally, the child’s father can take this policy. Mother can also proper if she has her own income. A grandparent can also propose if the child’s parent agrees. A legal guardian can propose if both parents are not alive.

When the risk cover will start for my child?

If your child is 12 years old, the risk cover will commence immediately.

If the age at entry is more than 10 years but less than 12 years, the risk shall commence from the policy anniversary coinciding with or next following the 12th birthday of the LA.

If the age at entry is less than or equal to 10 years, the risk will commence either after 2 years from the DOC or from the policy anniversary coinciding with or immediately following completion of 5 years age of LA, whichever is later.

Update: Child Future Plan Table 185 Has Been Discontinued.

Note:

The above is the product summary giving the key features of the plan. This is for illustrative purposes only. This does not represent a contract and for details please refer to your policy document.

Respected Sir,

I want ask my father start one of LIC policy dt:-6/2/2009 but before three months my father was expired & sum assured Rs. 1 lakh . So please tell me how many amount pay from LIC to her nominee .

Sorry for misshaping , Payment from LIC is depend that is this case was accidental or how

Please let me know whether there is any policy or package for children by paying one time premium.

I would like to gift to my grand daughter on her 1st birthday a deposit or policy which matures after 15 years.

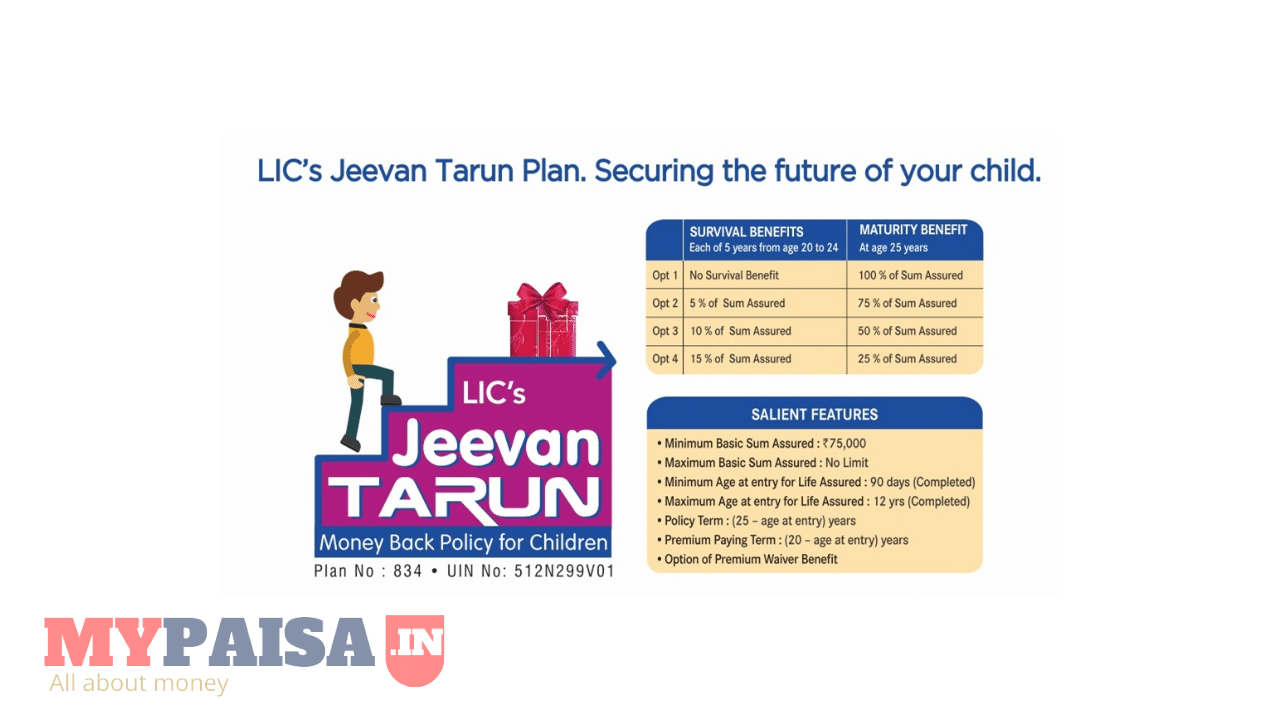

Sir Your thinking is great, you can take Jeevan ankur OR Jeevan Tarang for this child as a gift.

My son is 1yr old,kindly suggest some good monthly or half yearly paln for him for his better and bright future…..Awaiting for your reply

please take a SUPPER CHILD PLAN JEEVAN ANKUR from LIC is the BEST PLAN for your LUCKY CHILD its Guaranteed return money for your Child

my child age 1-1/2 years on 18 april Suggest me suitable policy for

her future with all terms and conditions. Thanx.

i have two daughters 6ys & 4ys. have any plan single invest & double cover like jeevan sathi for two children per yearly 5000 emi?

Dear Sir,

I am from mumbai.

I am going to insure for my baby in LIC Child future’s plan. He is now 1 yr old.

1 Can i deposit Rs.2000 / month?

2.My policy term is for 18 years.

3. so can you please tell me after completion of 18 years , how much amount i will get?

4. I am saving for my baby’s education n also for his future.

Please do the needful support

Send your baby’s date of birth and your date of birth by email, I will send you the quote.

which lic policy is better for 1 year child for education and career

Child career plan is the best for you.

Hi

Sir I have a policy under PWB plan for 5 yrs boy baby & policy No is 177567215. pliz tell me benifits of the policy for baby and is it a money back policy or simple.

I want to fix 100000 Rs for my daughter’s , So pl. suggest any LIC Fixed deposit plan. at DELHI

How many years you can wait?

I have 2 daughter One is 6 yrs and other is 1 yrs

please tell me which child plan should I take for both.

My monthly income is around Rs.18000/-

Child marriage plan or child career plan.