LIC Jeevan Shiromani Plan No.847 is the Money Back Plan. It is Non linked, Limited premium payment with a guaranteed additions plan. Shiromani is specifically designed for High Net-worth customers with a minimum Sum assured of Rs.1 Crore. The insurance cover starts immediately upon issuance of the policy.

Jeevan Shiromani Features:

- It is money back plan

- Minimum Sum Assured 1 Crore

- It also covers 15 Critical Illness

- Limited premium payment

- The policy term can be 14, 16, 18, or 20 years.

- Premium paying term will be 4 years lesser than the selected term.

Eligibility Conditions and Restrictions:

- Minimum entry age: 18 years

- Maximum entry age: 55 years

- Minimum basic sum assured (BSA) : 1 crore

- Maximum basic sum assured (BSA) : No Limit

Policy term and premium paying term :

- For a 14 year Policy : PPT is 10 years

- For a 16 year Policy : PPT is 12 years

- For a 18 year Policy : PPT is 14 years

- For a 20 year Policy : PPT is 16 years

Guaranteed Additions under Jeevan Shiromani:

- Guaranteed Addition for the first 5 policy years is Rs 50 per Rs 1,000

- From 6th Year onwards, Guaranteed Addition will be Rs. 55 per Rs 1,000.

Critical Illness Benefit (InBuilt) :

Jeevan Shiromani plan has an inbuilt 15 Critical illness benefit rider.

- 10% Basic Sum Assured will be Payable on Diagnosis of Critical Illness.

- Premiums will be Deferred for 2 years.

- Settlement options for the death benefit and survival benefit also available.

- The policyholder can receive the settlement amount, like death, survival benefit, or maturity benefit, in installments over the chosen periods of time like 5 years, 10 years, or 15 years. Alternately policyholder can also get one-time lump sum payment if he/she don’t want installment feature.

LIC Jeevan Shiromani Plan Benefit

Survival Benefit:

If the policyholder survives till the end of the policy period. The policyholder will get the following benefit depending on the opted policy term.

- 14 year Policy : 30% of Sum-assured is payable on 10th & 12th policy year. Rest 40% on 14th year.

- 16 year policy : 35% of Sum Assured on 12th & 14th year. Rest 30% on 16th Year.

- 18 year policy : 40% of Sum Assured on 14th & 16th year. Rest 20% on 18th Year.

- 20 year policy : 45% of SA on 16th & 18th year. Rest 10% on 20th year.

Maturity Benefit:

If the policyholder survives till the maturity of the policy, the policyholder will get the survival benefit mentioned above and he/she will also get Guaranteed Addition (GA) and Loyalty Addition (LA) on top of the Basic Sum Assured.

Death Benefit:

- If the policyholder dies within 5 years : Sum assured (SA) + Guaranteed Addition (GA) is payable to the nominee.

- If the policyholder dies after 5 years : Sum assured (SA) + Guaranteed Addition (GA) + Loyalty Addition (LA) is payable to the nominee.

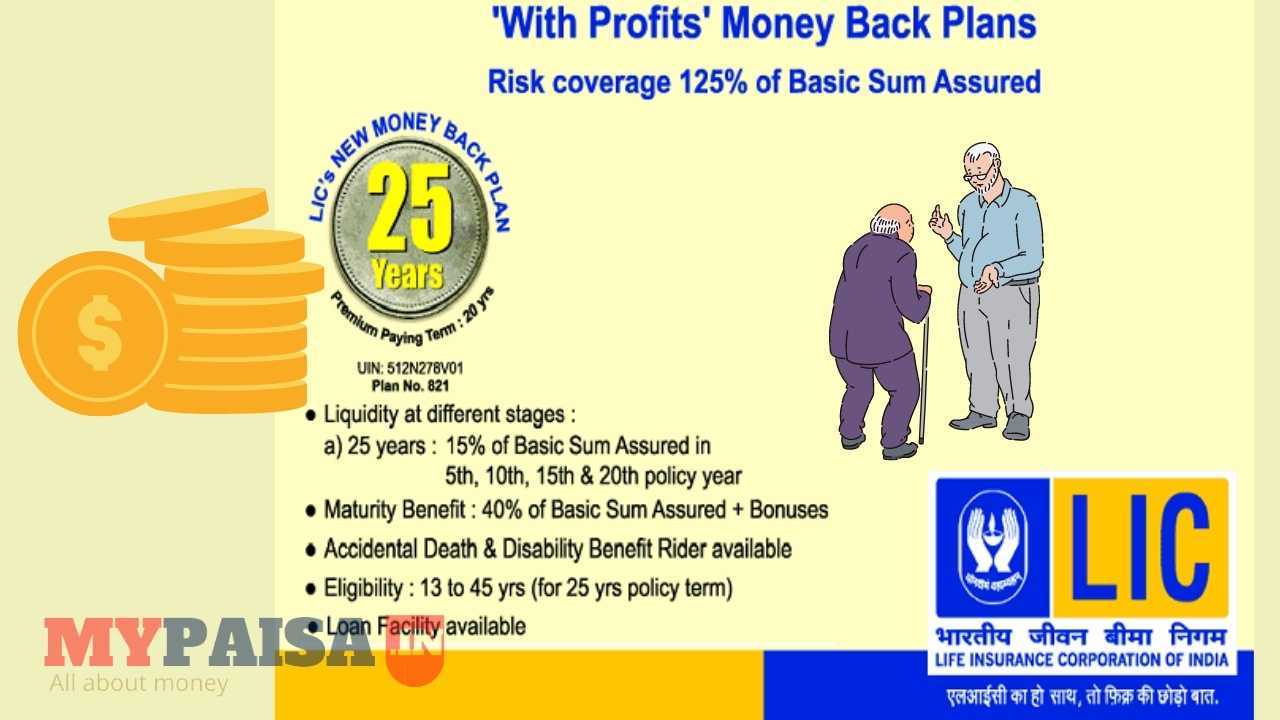

“Sum Assured on Death” is defined as HIGHER of the below.

- 10 times your annual premium (excluding taxes, the extra amount due to underwriter decisions or rider premium).

- 125% of Basic Sum Assured.

- 105% of all the premiums paid as on date of death.