Jeevan Nischay

LIC Jeevan Nischay Summary: (Table No.199)

Jeevan Nischay is a close-ended single premium policy with guaranteed maturity benefits exclusively for existing LIC policyholders.

Advantages of Jeevan Nishchay:

- Single-Premium policy.

- Guaranteed Maturity benefits with the provision of loyalty additions.

- The plan is exclusively for LIC policyholders.

- Wide range of policy terms options.

- Assured maturity benefits (Guaranteed Return + Loyalty Additions)

Assured maturity benefits equal to the Maturity Sum Assured are pre-defined. The specimen Maturity Sum Assured per Rs. 1000/- single premium is given below for some ages and terms:

| Age | 5 Years Plan | 7 Years Plan | 10 Years Plan |

| 30 | 1256 | 1409 | 1715 |

| 40 | 1249 | 1400 | 1699 |

| 50 | 1226 | 1369 | 1645 |

In addition to the assured maturity benefits, there is a provision for loyalty additions. Depending upon the LIC’s experience, the policy will be eligible for Loyalty Addition on death during the last policy year or on the Life Assured surviving the stipulated date of maturity at such rate and on such terms as may be declared by the LIC.

Death benefit:

The death benefit under Jeevan Nishchay policy is equal to five times the single premium if death is within the first year of taking the policy. In case of death in subsequent years, the death benefit is equal to the maturity sum assured. In case of the death in the last year of the policy, the death benefit is equal to the maturity sum assured with declared loyalty additions, if any.

Minimum Investment:

Minimum One Time Premium under Jeevan Nischay is Rs.10,000/- However, if the premium amount is Rs. 25,000 or more, the policyholder will receive a higher maturity sum assured due to available incentive.

Loans:

A loan facility will be available under this plan after the policy. The rate of interest charged for this loan amount would be determined from time to time by the LIC Of India.

Surrender:

The policyholder can surrender the policy after one year of commencement of the policy.

Eligibility Conditions and Restrictions for Jeevan Nischay:

Minimum age at entry : 18 years (completed)

Maximum age at entry : 50 years (nearest birthday)

Policy term : 5, 7 and 10 years

Minimum Single Premium : Rs. 10,000/-

Maximum Single Premium : Rs. 10,00,000/- (Premium shall be in multiples of Rs.1,000/-)

Maximum Basic Sum Assured (First Year Death Benefit) :

Lower of- Rs. 50,00,000, and 50% of total Sum Assured (total death benefit) under all existing in-force policies

Cooling off period:

If you are not satisfied with the “Terms and Conditions” of the policy, you may return the policy to Life Insurance Corporation Of India within 15 days.

The Unique Identification No. of Jeevan Nischay is 512N258V01

Note:

The above is the product summary giving the key features of the Insurance plan. This is for illustrative purposes only. This does not represent a contract and for details please refer to your policy document.

Update: Jeevan Nischay Table No.199 has been withdrawn, please check out other similar plans.

which policy is best for single premium .

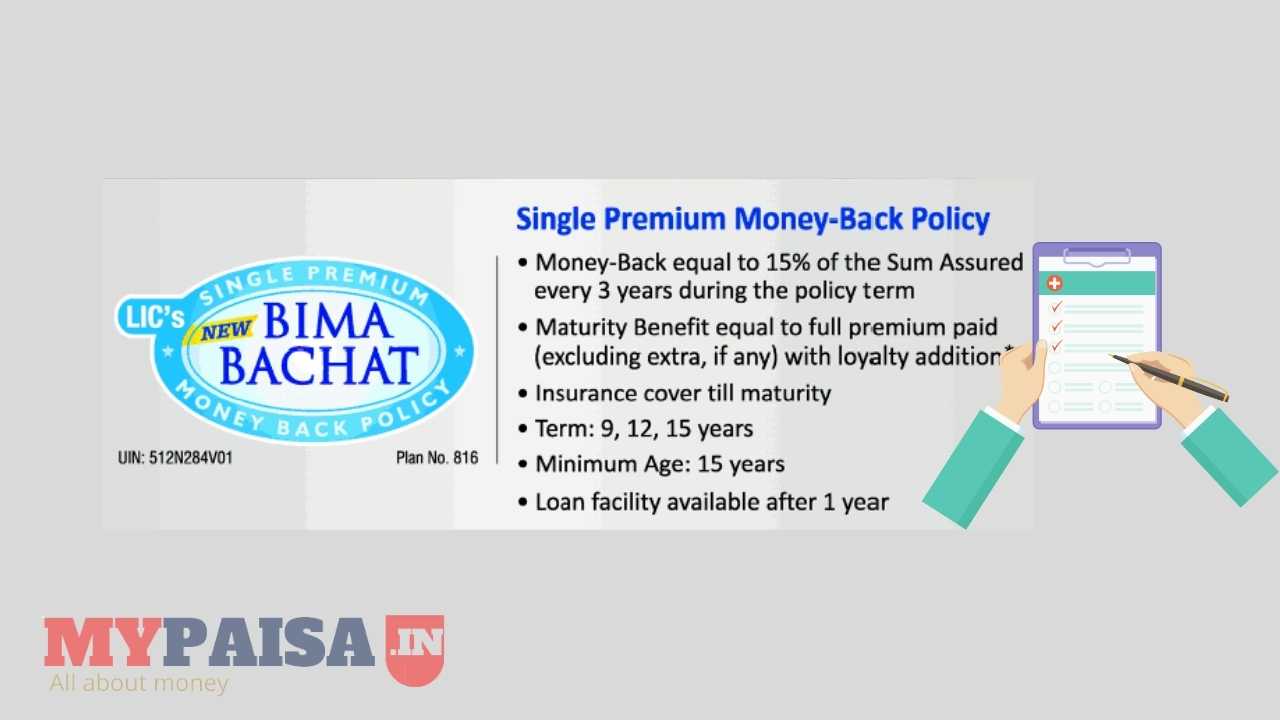

1. Bima bachat

2. Jeevan nischay

what is the return pattern (e.g. rate of interest)for LIC Jeevan Nischay plan?

is there any table for it?

send me latest updates of LIC via email or sms my Mobile no.

can i see regarding our policy in my mail which policies have already taken.If any other processor please tell me.with thanks.